As you know, most of our everyday economic transactions involve money (cash). So, we consider it appropriate to explain cash transactions from an accounting perspective. Having reached this point in the book, I assume you are aware of the accounting definitions of assets, debt, income and expenses (if not, you should read them first). You should also understand the idea of the double-entry in accounting, and the double-entry in a triple equation.

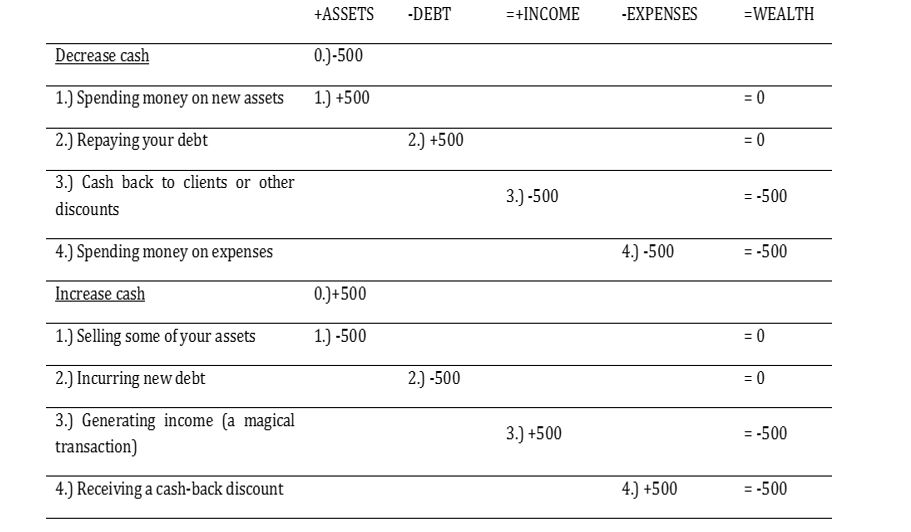

With those ideas firmly in mind, we can move on to saying that there are only two possibilities when it comes to your money transactions, accounting-wise: you either increase your cash or you decrease it. It’s as simple as that. Here’s how such things go:

You decrease your cash by spending it (you might also burn it, but that is not a smart thing to do). You can spend your cash on expenses, on repaying debt, or on acquiring new assets.

1.) Spending your money on new assets may have the most significant impact on your wealth bottom line, because it is assets that drive your income. The assets you acquire can be either tangible or intangible; the important thing is to acquire them. When buying new assets, consider the return they will generate, and any new debt you are incurring in the purchase. This kind of transaction has zero effect on your total assets – but only at point zero: the date and time of purchase.

2.) Repaying your debt is wise (as wise as it is unavoidable). Not doing so leads to bankruptcies, anger and fights (and in most cases, the fights are won by the lenders). This kind of transaction decreases both your total assets and your debt.

3.) Giving discounts in cash for sales already concluded.

4.) Spending on expenses is where your management skills matter. Expenses are unavoidable but manageable. Managing them is all about balancing between present and future, your current lifestyle and your future opportunities. Expense management is also a matter of striving for efficiency. This kind of transaction decreases your wealth on both your balance sheet and your income statement.

Increasing cash (that sounds way better, doesn’t it?) can be done in just four ways. Actually, there is a fifth, hidden way – but only governments and banks can do it legally: printing money. Here are the legal ways:

1.) Selling your assets whether for a gain or loss. (selling was covered in “Complex Transactions and the Perfect Accountant.” )

2.) Receiving money you have to return in the future, with interest charged. Going into debt.

3.) Generating income – a magical transaction that may sometimes appear in a person’s economic life. More on that in other articles.

4.) Receiving cash-back discounts for your past purchases.

Those are the basic types of things you can do with your cash (from an accounting perspective).