Here is the next article; this one is about recording your debt.

Debt plays an important role in our lives; it increases the flow of money in the economy. The total global public debt is estimated at around $40,000,000,000,000 – that is 40 trillion dollars and growing.

USA

If you do not have cash, but do have assets or a secure job, no problem – the banks will lend you money to finance a new activity. There is only one catch: you have to pay them back what you borrow, plus interest. So banks are making income when they lend you money, but they structure their loans in such a way that you do not pay much attention to this fact. The thing most advertised when it comes to consumers loans is the monthly payment. So, to manage your debt well, you must keep track of both your outstanding balance and interest paid.

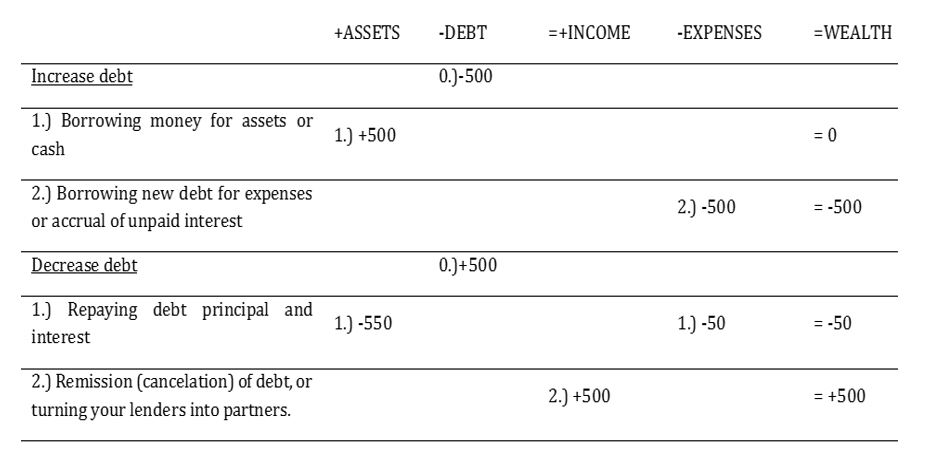

Now let’s go through all the possible debt transactions. Remember that incurring debt is a complex transaction. Just as we’ve done before, we will divide debt transactions into two categories: ones that increase your debt and ones that decrease it.

You can increase your debt in two ways. The first, straightforward way is simply borrowing – incurring new debt. It is important to consider what you will buy with this debt. As you may already know, you can borrow to finance new assets or to receive cash.

- Financing asset purchases can be smart, if the cash flows generated from the new assets can repay your loan.

- Financing your expenses with debt, on the other hand, is dangerous. It deteriorates your wealth. However, it can be a smart and appropriate action when it allows you to increase or advance your business processes. Inventory turnover, for example, or payment collection, or some special educational opportunity which will help you grow your income.

The final type of transaction (but the most probable) occurs when the unpaid interest on a loan has accrued (has been added to) your outstanding balance. In other words, part of the total interest you will eventually owe has become due but has not yet been paid.

Decreasing debt, as exciting as it may sound, can be done in two ways (from an accounting perspective).

- Repaying your debt using your assets. This type of transaction is the most common of all. You are obligated to repay any debt, and that payment is typically executed in cash. In some cases (such as bankruptcy) repayment may be done using other material assets.

- Canceling your debt. This is a rare type of transaction, done only in extraordinary circumstances. In the corporate world, you can reduce your debt by turning your lenders into shareholders. In practice, lenders do not like to change roles, so they go with this option only if the future looks either very dim or exceptionally bright.

Those are the basic types of things you can do with your debt (from an accounting perspective). Do you have any other ideas?